CLM Framework

Your modular, quickly available and economical omni-channel client life cycle management solution

CLM Suite

Your modular, quickly available and economical omni-channel client life cycle management solution

CLM Framework – digital from account opening through the entire customer lifecycle

Digital from account opening over the entire customer life cycle – our CLM Suite solution enables you to quickly create a seamless, end-to-end digital process for your private, business and corporate customers.

Conveniently select banking products and services as on a shopping platform and configure them in a shopping cart. Digitally capture identity documents, company information and documents, sign them once digitally and immediately the account and the selected banking services are available. Online self-service and via mobile device in the bank branch. For private, business and corporate customers. With CLM Suite you create a modern and emotional experience for your customers and efficiency in the back office in a very short time.

CLM Framework Benefits

Uninterrupted opening of customers and banking products in one session increases the closing rate

Seamless omni-channel journeys intensify positive customer interaction and increase the sales success of related and higher-value banking products & services

Automation of back-office processes reduces manual work and opens scope for condition design

Increased data quality and strong reduction of error susceptibility and compliance risks in the processes

Your CLM Suite is up and running within deux months and increases your sales already within one year!

CLM Framework Key Features

Comprehensive, pre-configured omnichannel client journeys across the entire customer lifecycle

Completely paperless front-to-back processes that ensure an emotional customer experience

Integrated sets of rules for customer, product and document logic as well as embedded compliance, tax and money laundering regulations

Easy integration of bank-owned GUIs / 3rd party apps and their core banking environment via APIs

Finished CLM basic components and modular design ensure rapid implementation without programming effort

Minimal integration effort into your core banking environment through high compatibility (APIs) and flexible integration plug-ins

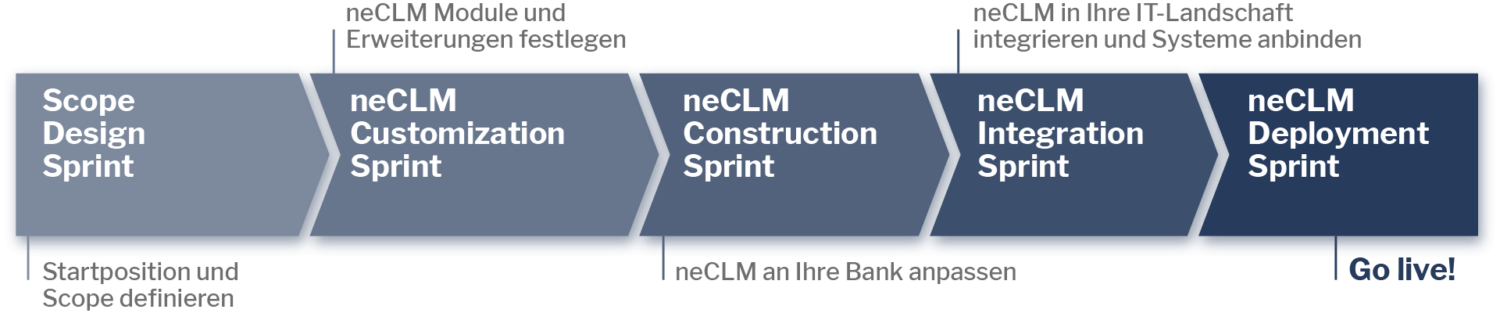

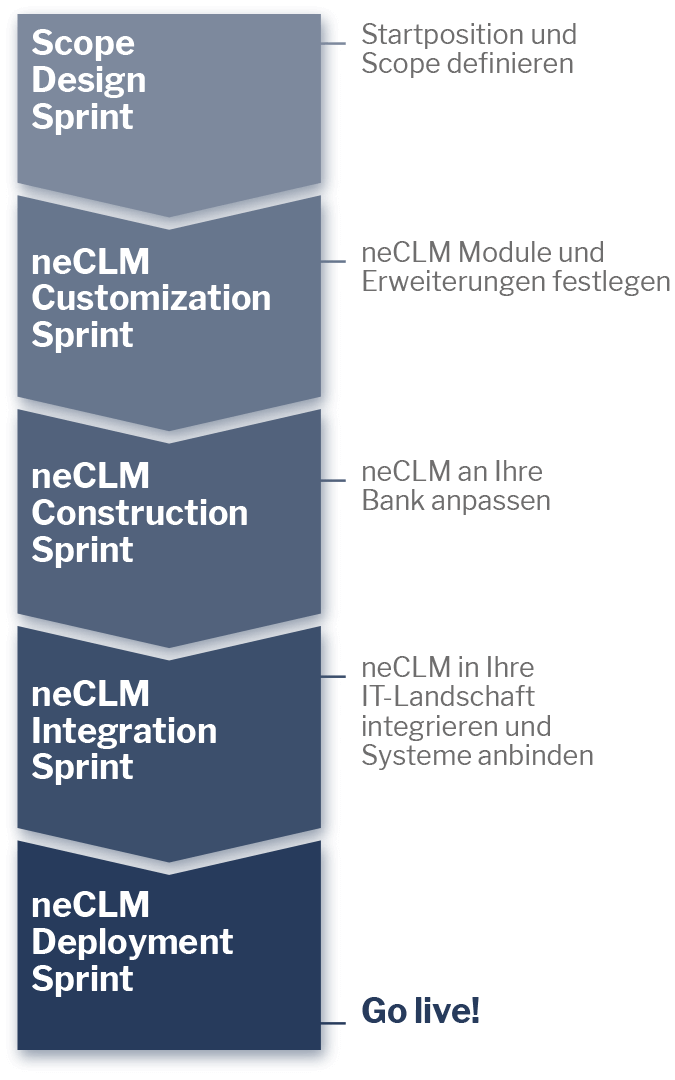

How does CLM Framework come to you?

Together with our technology partners, we will provide you with the solution ready for operation – your CLM framework can be live after just two months.

Do you have any questions?

Request a demo now

CLM Framework: our solution in detail

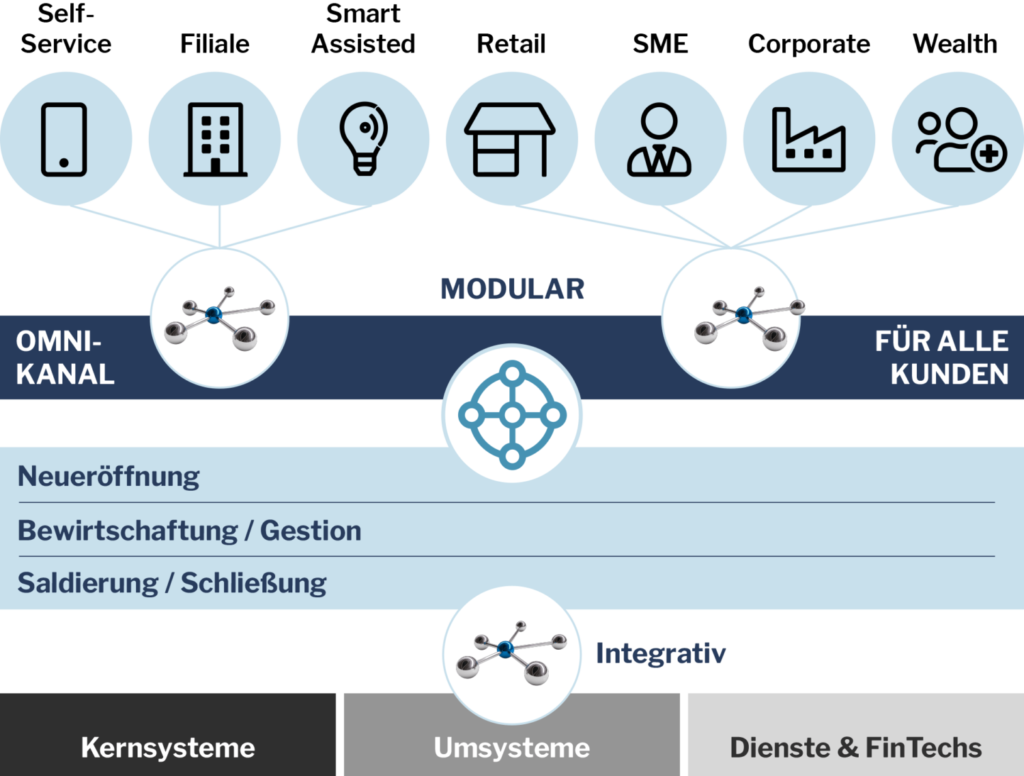

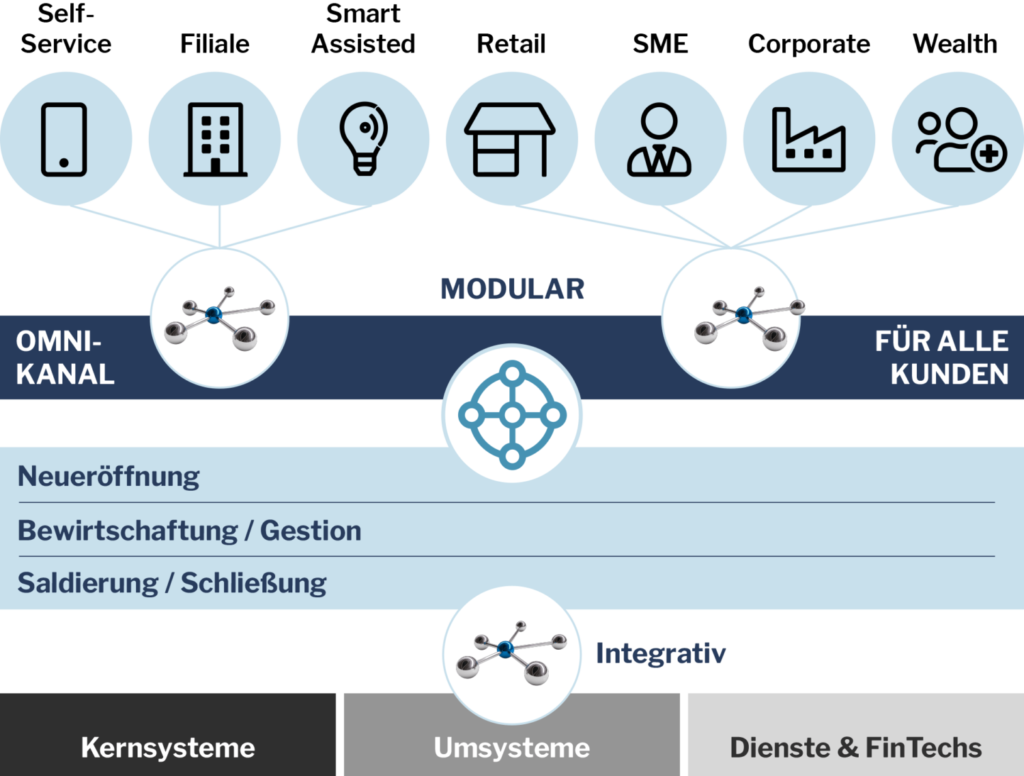

Modular design

22nd CLM solutions consist of three main modules: opening “self-service” as well as “branch”, management (orchestration) and netting (closure), which enable a targeted start and, based on this, a secure successive expansion.

Customer segments and products

CLM Suite enables a cross-channel customer experience that your customers have been accustomed to from retail shopping platforms for years.

Via a configurable product shop with shopping cart functionality, your customers can put together all your basic products easily and clearly.

CLM Suite covers all your typical basic products, including different account types, all major cards and e-banking options.

Furthermore, product packages (sets) as well as product versions for children, adolescents or students are also supported.

Automatic reading of ID card data

During personal identification in your branch, the machine-readable ID data (so-called MRZ) is automatically read out and compiled for your customer and the customer advisor in a clear manner.

Integration with core system

Sophisticated integration plug-ins ensure fast and low-effort connection to your core banking system.

Integration with peripheral systems

CLM Suite includes numerous other integration plug-ins, e.g. for Business Verification, Output Management, Archive and UVM, more can be activated at any time.

Comprehensive business and compliance regulations

CLM Suite includes extensive regulations in the areas of customer restrictions, product suitability and document logic.

All relevant compliance requirements regarding KYC are covered.

Adjustments are made by configuration – i.e. without programming

Omni-channel support

Your processes can be carried out by your customers through various channels.

For example, a customer opening can be started in self-service (app or browser) and seamlessly terminated with the employee in the store.

Sanctions list check and PEP check (Politically Exposed Persons)

CLM Suite carries out automatic money laundering checks and thus enables a quick opening of the business relationship.

Potential customers with increased risks are identified at an early stage and documented and approved based on risk.

Integration with external services

External services such as commercial register, PEP check as well as video identification & signature and online identification are also available via existing integration plugins.

Optional services

Connection credit check

The processes can be supplemented by the integration of the Central Office for Credit Information (CH) or comparable services in DE & AT.

Address check with address database

Address verification using an address database

Integration into employee portal / consultant workstation as well as customer website / customer portal

CLM Suite can be accessed via the included modern user interfaces (WebComponents) or an API in your employee portal or your consultant workplace as well as in your customer portal.

Direct generation of PDF documents

In addition to the use of existing output management systems, CLM Suite can be supplemented by a component for generating documents (PDF) if required.

Individual expansion

Customer-specific process enhancements

Customer-specific integration enhancements

Due to the open technical architecture (API), CLM Suite can connect numerous peripheral systems as well as external services. If required, we also offer you an integration layer for the overall solution of internal and external integration requirements.