We create emotional & end2end digital customer processes.

For about a decade, the topic of digitization has also been moving higher and higher on the agenda of financial institutions in the DACH region. There is no question that banking transactions will be digitized even further. Which makes digitalization even more important to drive initiatives forward! In order to design practical solutions with real added value, it is also important to reduce the complexity of these projects. Because the range of topics is enormous – which is why we have made it our mission to support you in all these areas:

Digital banking customer advisory

Our highly specialised consulting boutique is a market leader in omnichannel & digital consulting processes

Client Lifecycle Management

22nd offers financial institutions and payment providers tried-and-tested reference models with which they can drive forward their digitalisation strategy quickly, in a potential- and solution-oriented manner.

Client Onboarding

Together with solution partners, 22nd implements fast, efficient and end-to-end digital new customer and new product processes with integrated digital KYC & KYB solutions and allows intelligent cross- and upselling.

M&A & PMI Services

Generating high value from M&A transactions depends on the right strategic decisions and carefully orchestrated post-merger integrations. 22nd has proven expertise and skills to maximize the value of the deals at every stage. Our clients are both corporations and global private equity firms.

Due Diligence

Our due diligence approach gives our clients maximum insight. Our due diligence expertise focuses on market and strategy, operations, technology and IT, marketing and sales, leadership and personnel analysis. We analyze large amounts of information in the shortest possible time, focusing on all the essential details with advanced analytics and AI. This includes valuation consulting, industry knowledge as well as perspective and process management of due diligence.

We help buyers to determine the sizing, realize significant synergies and ensure the way for a smooth transaction process. For private equity, we enable deep industry knowledge and insights into profit-enhancing operational changes, automation and sales improvements.

22nd not only provides you with a solid business case based on strategic insights and fact-based analysis, but also helps you implement and execute all your plans.

We are aware of the urgency of the bidding process in today’s highly competitive environment.

Our in-depth knowledge of the due diligence process allows us to complete assessments in an accelerated timeframe while providing detailed, substantial information and insights. For due diligence, we put together specialized teams of industry-leading experts and can rely on our own benchmarks & frameworks.

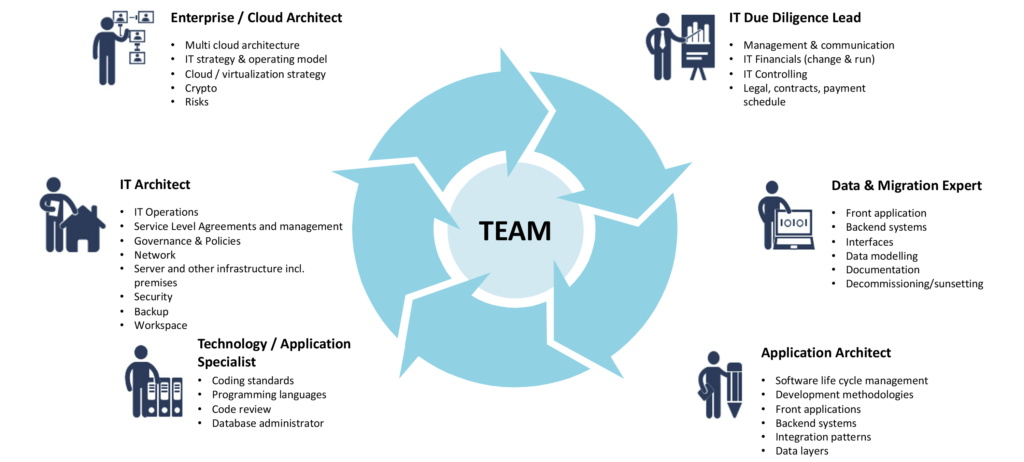

The right team of experts is crucial to identify weaknesses and uncover risks to the IT organization

Post-Merger Integration

We support you by contributing our experience from all the successful projects from the integration of small companies to large companies with hundreds of employees. We use our proprietary set of methods to manage the complexity and ensure that the integration achieves the intended business goals:

- People and Culture Monitor: Based on methods of applied psychology, we observe behavior, values, motives and analyze causes, e.g. with empathetic, structured exit conversations.

- Organizational models: Summaries of all our projects, improve the fast-decision-making process about joint organizations

- Our benchmark database: contains hundreds of detailed KPIs that allow us to estimate and validate potential synergies and improvements, especially of processes.

- We define synergies top-down and validate them bottom-up by developing a detailed plan for their implementation.

- We leverage our expertise in the areas of digitalization, CLM and operational excellence to quickly bring the organization to the highest standards.

- We have ready-made PMI plans to ensure business continuity and quality of service throughout integration and transformation.

Dire check points for a successful integration (PMI)

- Goals & Project Org.

- Define the basic objectives

- Manage the integration as a discrete project

- Organize integration teams around drivers of value and the TOM

- Appointed teams from leaders of both companies

- Implicate senior leadership that is committed, credible, and highly visible

- Value creation

- Emphasize speed and make a clear plan

- Pursue synergies according to the integration’s objectives

- Protect the current business strong by staying close to customers in the integration process

- Make clear decisions

- Organization & Communication

- Communicate regularly, open and direct

- Define clear day-one structure & responsibilities

- Design the future operating model early in the process

- Manage talent by selecting, retaining, and developing the best people

- Deeply understand people and manage the cultural integration

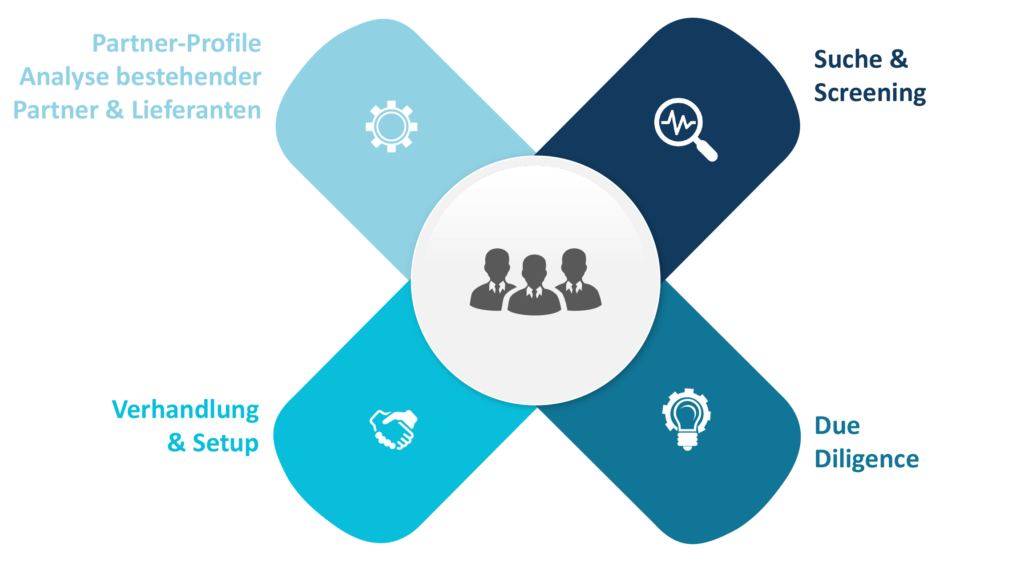

Strategic Alliances & Partnerships

We help companies to identify and build strategic alliances and partnerships to drive innovation and sales, add key capabilities, or reap the benefits of scaling.

We use our global network of private equity partners, leading advisory firms and M&A advisors to find the best solution. Strategic alliances should be based on a long-term win-win situation, allow for deeper collaboration compared to a typical vendor contract, be easier to set up than joint ventures, and allow for partial collaboration (e.g. in a region, for a particular technology or product).

Partnership models often need well-thought-out incentive plans, especially in the distribution partnerships, to motivate the partner, but at the same time not to dilute your margin (see also Sales Improvements).

Strategic alliances and partnerships drive innovation, sales, add critical capabilities and leverage the benefits of scale

Operational excellence

Banking & Payments Industry

Audit & Analytics

Our experts conduct a structured assessment based on our benchmarking framework for operational excellence and a potential analysis to provide actionable information. Our main goals are to improve our customers’ business, turn an activity into a profitable process, improve customer journey and satisfaction, and identify areas where cost reductions are possible. Ideally, contact centers can be transformed into opportunity centers with positive revenue contributions through cross- and upselling.

Reorganization

From our audit and analytics phase, we propose a clear strategy to support the processes with the greatest need for optimization. We outline a plan to improve the efficiency of your human resources, finance, human resources and sales processes and design your new organizational structure according to customer and business requirements.

Operational KPI Framework for Banking & Payments

Aligned with your strategy, we develop a KPI framework to help you track your progress and achieve your goals. In this project phase, we analyze your financial, commercial and operational strategy in a structured valuation approach. From our assessment, we develop dashboards and reports to help you gain the insights you need for your operation. We quickly develop the dashboards based on our proven templates and supported by our benchmarking database and implement them in existing CAS, distribution systems and IT environments.

CAS evaluation (deep knowledge of functionalities)

We frequently evaluate contact center solutions for global customers and have a proven framework of best-in-class, detailed assessment grids with deeply granular capabilities to help you quickly find the best solution for your business. We regularly compare the pricing so that we can optimally support you in your negotiations.

Knowledge management

We help companies of all sizes derive tangible business value from their knowledge: by designing knowledge management strategies and frameworks, providing knowledge management initiatives and basic knowledge management toolkits.

Our comprehensive accompanying program includes the assessment and benchmarking of knowledge management, the development of a knowledge management strategy (including the knowledge storage strategy), and the planning and support of implementation.

Training and team analysis

We analyze your teams, operations and HR processes in a structured evaluation approach and potential analysis. Based on our methods and best practices, we help you to improve your processes and structure the necessary training. Everything to shorten the training time of employees and improve the skills of your employees.

Based on the results of our primary analysis, we develop a structured assessment framework that supports the operational success of your teams through systematic agent evaluations.

Incentive and motivation programs

We support the development of results-based incentive and motivation programs so that you can build and develop a team that works together to achieve results that cannot be achieved through individual performance.

Our experience with results-based compensation programs provides your business with:

- Easy-to-manage program policies and scorekeeping tools

- Reduced revenue due to the investment of team members

- Long-term motivation for teams and individuals

- Budget-friendly program structures that avoid high labor costs in times of low sales

- Strengthening a team spirit in which everyone is rewarded for corporate success

Automation and self-service

Based on our audit and analytics phase, we support the development of a complete self-service solution for non-value-added services. In addition to cost savings, we are able to automate repetitive and boring tasks to leave more interesting tasks to your employees.

Merchant Payment Improvement

Based on our deep payment knowledge and market understanding, we enhance the payment processing capabilities of merchants businesses. This integrates various technological aspects and implementation strategies to create a seamless, efficient, and secure payment experience for both merchants and their customers.

Our focus improvement areas

- Enhance customer experience and top line turnover, reduce drop out & abandon, higher acceptance incl. Alternative Payments Methods (APM)

- Fraud and Risk Management: We identify best providers that will minimizes fraud loss and maximizes revenue through advanced risk management and monitoring solutions

- Omnichannel Customer Experience: We analyse the merchant and identify omnichannel potential helping merchants to deliver a consistent omnichannel commerce experience, integrating payments across all customer touchpoints

- Payment costs & coverage: For majority of businesses, transactions fees are based on >100 criteria we use to compare payment service providers and find the best fit for our customers. This enables businesses to cater to a diverse customer base. We also identify the payment Alternative Payment Methods (APM) to increase merchant’s payment coverage and increase customer conversion rate

- Value Added Services: Identifying potential value added services (e.g. DCC, Tax Free, etc.) to add more value for merchant’s customers as well as additional revenue streams for Services with revenue share model the Payement Service Provider and the merchant are sharing.

- Integration and Scalability: We evaluate actual and potential providers’ scalability and integration ease to support the flexiblity to scale as the business grows

Based on our knowledge, we have build our Merchant Payment Improvement Program (MPIP) as a multifaceted initiative that combines strategic implementation with cutting-edge market insights to revolutionize payment processing for merchants businesses.

Sourcing Strategy & Near-/Offshoring Evaluation

With a structured valuation approach and a potential analysis, we analyze your back office, your operations-, finances- and HR-processes for possible sourcing scenarios. During this analysis, we interview sales & marketing as well as current and potential customers. Based on our European nearshoring database and benchmarks based on real cases, we can quickly identify potential savings, but also associated risks.

Sales Improvements

Incentive Plans

We analyze your sales (quantitative & qualitative analytics) and your incentive plan. We evaluate and refine your existing sales incentive plan or design a new one based on simulation tools.

A well-designed incentive system for sales is the best way to attract, retain, and motivate high-performing salespeople

We integrate the incentive plan into your company-wide performance management system.

Cross Selling

Use Case: European Acquirer

We have built a completely new outbound team and enabled existing call center teams to cross- and upsell – from the customer journey to the fully successful implementation as a B2B2C service, evaluation of products/pricing/upsell; CRM, telephony system, simulation training based on use cases, training material and rollout plan, escalation processes to customer loyalty and sales teams. This included a full incentive program.

Result:

Successful implementation of cross-, upselling and campaign support with over 1000 successful deals in the SME sector for the acquirer within the first 3 months

Smart Finance

Together with solution partners, 22nd designs and implements intelligent and end-to-end digital financing processes for private and SME customers with a special focus on value-adding products and services for small and medium-sized enterprises.

Smart Invest

Together with solution partners, 22nd designs and implements intelligent and end-to-end digital processes around the investment topic.

Smart Compliance

22nd implements compliant processes and solutions. We create efficient processes and define effective controls. Our team of consultants has experience in the areas of compliance according to FATF & FINMA standards, 4.&5. AML-RL, GWG & VSB, SRO rules, customer protection according to MiFID II & FinSA as well as FINIG, FATCA & GMSG (AT).