Independent Software Vendors Database

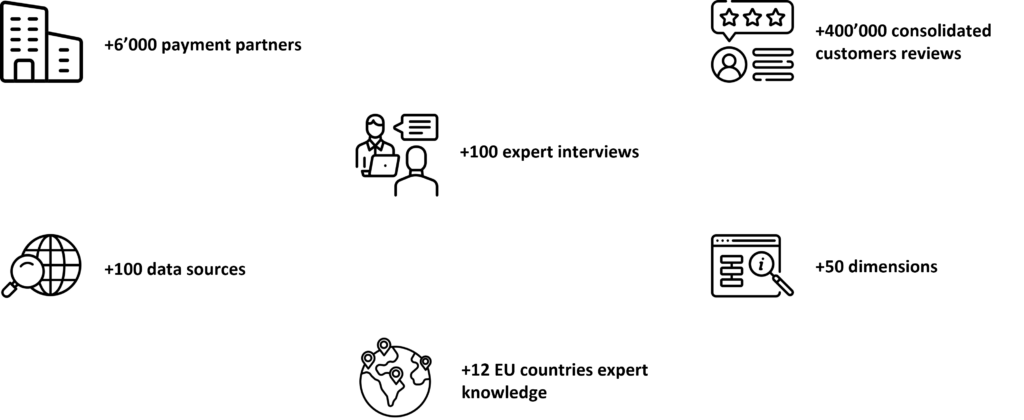

In the last article I lined out the complexity of the payment world with the n party model. We would love to share some insights of our several years of deep research and over 100 expert’s interviews in the Independent Software Vendor (ISV) market, since this became lately a focus for payment service providers, banks and private equity companies. To better support our clients, we developed our own payment software partners database, since no complete & reliable information is actually available on the market (e.g. Capterra or Getapp). Our Independent Software Vendor Partner Database is an extensive resource for businesses looking to find the right payment partner for their needs. It offers comprehensive data of over 6,000 possible payment partners mainly across Europe, including over 50 dimensions, including:

- ratings & reviews

- industry or vertical

- contact & management information

- geographical presence

- detailed business description, products & services offered

- 22nd Quality Index

This allows us to quickly identify for our clients the best fitting partner based on their specific needs. Whether it is a project about vertical specific deep dive & market development insights, a strategic partners identification & deep market trends understanding or lead generation & new market entries. This is a basis to support our clients in addressing their needs efficiently and getting fast reliable results.

Additionally, apart from various filtering options our database also offers the 22nd Q-Index, which is built of various ratings, reviews from ISV customers as well as other impacting factors, giving our clients an objective & unbiased first evaluation. This helps clients to quickly and efficiently identify ISVs that meet their needs and fit their strategy in the best way.

How do we find the data and continue updating and expanding our database?

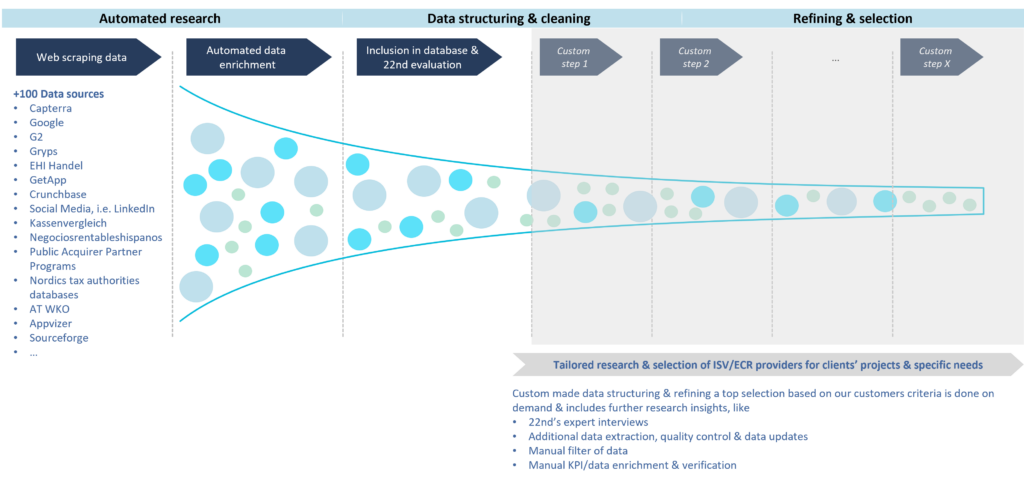

Our payment partner database was created using an extensive and rigorous methodology to ensure that our customers have access to the most comprehensive and accurate information about payment partners (see graphic below). The main reason was that we simply couldn’t find the desired information in one place – no complete overview exists for the fragmented market of ISVs.

We began our data extraction process with our own developed AI based web scraping data tool from public Acquirer Partner Programs, public web databases, software comparisons, ratings, and specialists’ comparison portals such as Capterra G2, Google and Getapp. This allowed us to collect a large amount of data from over 100 different data sources.

Once we gathered the data, we applied a set of automated filters to ensure that only reliable and accurate information was included in the database. We then compared the new data with our existing database, and rated each company individually based on their services, payment types accepted, and more. We applied manual filters & data enrichment to further refine the data and proceed to expert interviews to complete any missing data, as well as gather further expert insights into our research.

Throughout the process, we also ensured that the data in our partner database is up-to-date and accurate. We regularly monitor the data sources and update our database when we spot any changes or discrepancies, so our customers can be sure that we always work based on the most up-to-date information. Additionally, our team of experts is available to answer any questions and provide guidance for businesses throughout the process.

How could we support you with your project and ideas?

What insights could help you to make better decisions and help you to reach your goals?

Written by Markus Melching